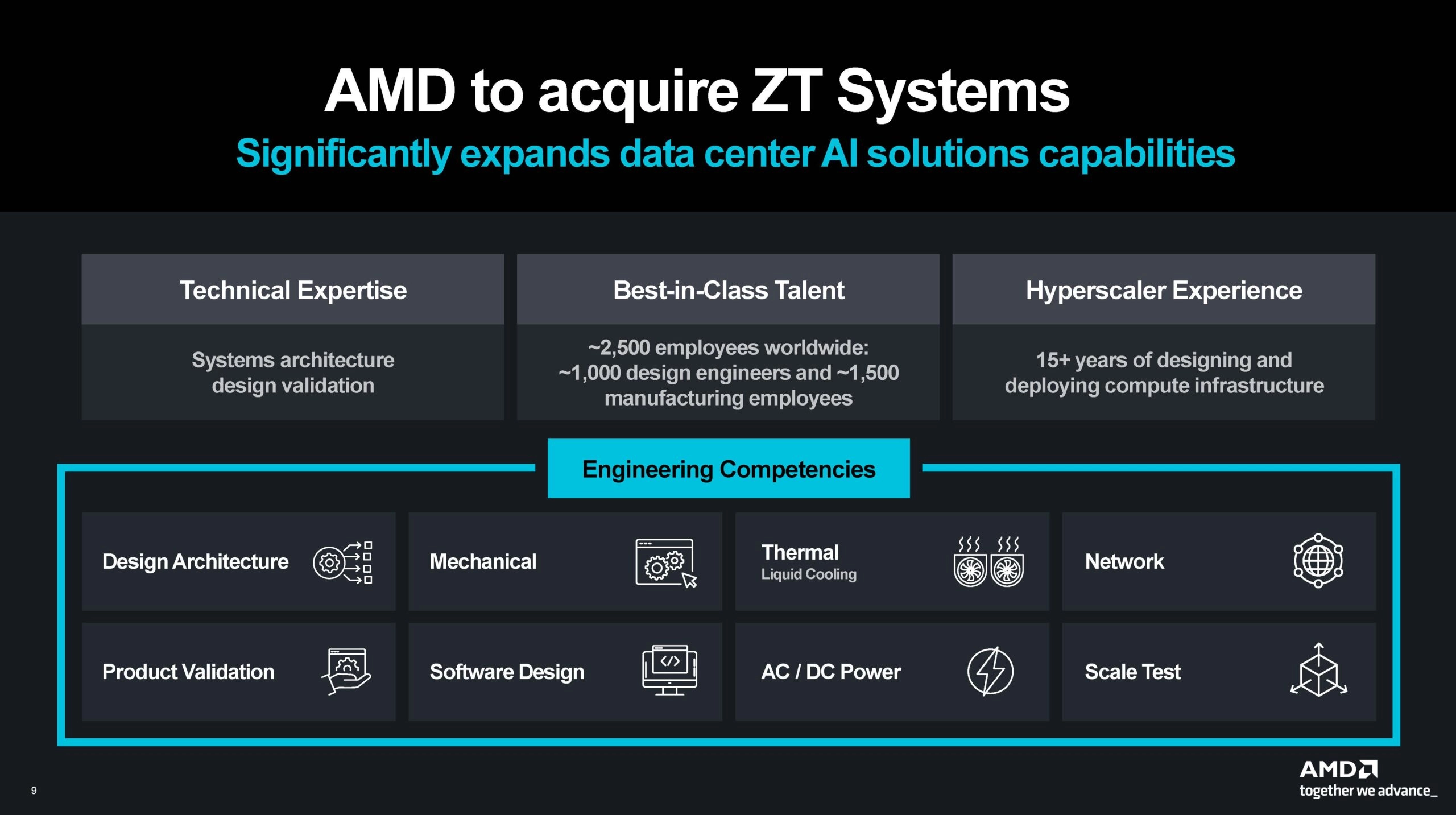

This morning, AMD announced its acquisition of ZT Systems, a company known for constructing major hyper-scale AI systems for AMD. This move sheds light on various aspects of the AI industry and marks the beginning of a series in our Substack to delve deeper into this topic.

AMD Acquires ZT Systems in Unexpected Deal

The transaction is priced at $4.9 billion, with an additional $400 million payment pending later. Nevertheless, the actual value of the deal is anticipated to be lower as both companies have confirmed plans to offload the ZT Systems manufacturing division. Considering the scale of this manufacturing operation, it’s likely to attract interest from several large buyers.

Potential buyers could include major firms like MiTAC, QCT, HPE, Dell, Supermicro, Sanmina, Flex, or even private equity firms. AMD Acquires ZT Systems, acquiring this business could particularly benefit HPE as it strives to enhance its position in the AI sector, competing with frontrunners like Supermicro and Dell. Following the acquisition, AMD will categorize ZT Systems’ earnings as discontinued operations and aims to divest the manufacturing sector swiftly due to the competitive dynamics with its client base, emphasizing the urgency of this divestiture.

AMD Acquires ZT Systems, a typical large AI cluster consists of several core systems. Top-tier system components include AI accelerators, GPUs, CPUs, RDMA NICs, and switch chips. On the other hand, lower-tier components involve liquid cooling systems for both data center and rack cooling, power supply solutions for data halls and buildings, rack designs, management networks, and physical security measures. It’s apparent that a small number of companies (around 2-3) dominate the production of high-end system components, while a larger group (often more than 10) handle the lower-tier components.

For AMD, possessing an 8-way GPU system is beneficial but only partially addresses challenges. Companies must also tackle the deployment of such systems as new resources for power and water become available, particularly in regions like the US and Europe.

AMD Acquires ZT Systems – AMD’s acquisition of ZT’s engineering capabilities propels this acceleration. When considering AMD’s potential $4-5 billion in AI server revenue this year, it’s important to recognize this as equivalent to only 1-2 GPU clusters. Supermicro, on the NVIDIA front, can now deliver a $4-5 billion cluster in under a month. For AMD to effectively compete with NVIDIA and justify its investments, it needs comparable technology, competitive pricing, and rapid availability. In the current market, where GPU clusters are expansive, delays of one year for a cluster to become operational are deemed unacceptable. AMD Acquires ZT Systems, a three-year timeline, like that for a HPE-Cray government Exascale supercomputer, is now considered exceedingly slow.

What is the recent acquisition announced by AMD?

AMD has announced the acquisition of ZT Systems, a company recognized for constructing hyper-scale AI systems. AMD Acquires ZT Systems, the deal is valued at $4.9 billion, with an additional $400 million payment pending later.

Why is AMD acquiring ZT Systems?

AMD aims to enhance its AI deployment capabilities and address the increasing demand for hyper-scale AI infrastructure. The acquisition focuses on accelerating AMD’s engineering capabilities and optimizing the AI Speed-to-Deploy (STD) metric.

What will happen to ZT Systems’ manufacturing division after the acquisition?

AMD plans to offload the manufacturing division of ZT Systems due to competitive dynamics with its client base. AMD Acquires ZT Systems, potential buyers could include HPE, Dell, Supermicro, MiTAC, QCT, Sanmina, Flex, or private equity firms.

How does this acquisition position AMD in the AI market?

With ZT Systems’ engineering expertise, AMD can better compete with NVIDIA and other industry leaders. AMD Acquires ZT Systems, the acquisition aims to address deployment delays and improve AMD’s competitiveness in delivering large-scale AI clusters.

What are the key components of a large AI cluster?

AI clusters consist of:

Top-tier components: AI accelerators, GPUs, CPUs, RDMA NICs, switch chips

Lower-tier components: Liquid cooling systems, power supply solutions, rack designs, management networks, and physical security systems

Why is AI Speed-to-Deploy (STD) critical for AMD?

In the competitive AI industry, delays of one year or more in operational deployment are considered unacceptable. AMD Acquires ZT Systems, the AI STD metric ensures faster deployment timelines, which are crucial for AMD to stay competitive against companies like NVIDIA and Supermicro.

What challenges does AMD face in the AI deployment market?

AMD must address factors such as technology parity, competitive pricing, and deployment speed to compete effectively with market leaders like NVIDIA and Supermicro.

How does the acquisition impact HPE?

If HPE acquires ZT Systems’ manufacturing division, it would significantly strengthen its AI sector position, allowing it to compete better with Supermicro and Dell.

How much is AMD expected to generate in AI server revenue this year?

AMD is projected to generate $4-5 billion in AI server revenue this year, which equates to roughly 1-2 GPU clusters.

What’s the final takeaway from AMD’s acquisition of ZT Systems?

AMD’s acquisition of ZT Systems enhances its AI deployment capabilities while avoiding competition with its allies. AMD Acquires ZT Systems, the divestiture of ZT’s manufacturing division could see HPE emerging as a stronger player in the AI sector.

Final Words

AMD Acquires ZT Systems, our assessment is that the total acquisition cost of ZT Systems by HPE will likely be significantly lower than the projected $4.9 billion after the disposal of the manufacturing division. This move would promptly position HPE as a noteworthy player in the AI domain, a field where it has previously been outpaced by competitors like Supermicro and Dell. Meanwhile, AMD is enhancing its capability to meet the AI Speed-to-Deploy (STD) demands of its clientele without competing with its allies. AMD Acquires ZT Systems, failing to focus on the AI STD metric could jeopardize its future competitiveness. This scenario resonates profoundly for any AI startup operating outside the realms influenced by major players like NVIDIA, AMD, Cerebras, and possibly Intel.

ColoCrossing provides enterprise-grade colo and colocation solutions designed for reliability, security, and scalability. Our infrastructure supports high-performance bare metal server deployments, including bare metal dedicated server and bare metal dedicated servers built for demanding workloads. With industry-leading dedicated hosting , we deliver some of the best dedicated server hosting options backed by robust networks and expert support. Whether you need flexible dedicated server hosting , a powerful dedicated server , or fully managed dedicated servers , ColoCrossing delivers dependable performance and full control to power your business.

ColoCrossing excels in providing enterprise Colocation Services, Dedicated Servers, VPS, and a variety of Managed Solutions, operating from 8 data center locations nationwide. We cater to the diverse needs of businesses of any size, offering tailored solutions for your unique requirements. With our unwavering commitment to reliability, security, and performance, we ensure a seamless hosting experience.

For Inquiries or to receive a personalized quote, please reach out to us through our contact form here or email us at sales@colocrossing.com.